Silver Wheaton

Current Price-10.51

Recommendation- Strong Buy

12 Month Price Target- 16.25

Summary

Summary Silver Wheaton should continue to outperform both silver and all other silver stocks based on its unique, low risk, leveraged model of buying forward by product silver production. This model makes Silver Wheaton the only unhedged pure play on the expected rise in silver. Since they are not a mine operator they do not carry the operational risk of conventional silver miners. Its unique advantages to traditional silver producers should give it a premium while giving investors the best exposure to silver, an asset likely to outperform gold and other metals going forward.

Price Target The 12 month price target of 16.25 is based on a 2007 earnings estimate of $.65 assuming an average silver price in 2007 of $15. This price target assumes Silver Wheaton will command a premium over its current forward PE of 16 to 25 based on its attractiveness to funds and investors looking for low risk exposure to silver. If retail investors become more interested in silver stocks and the price of silver spikes, Silver Wheaton could briefly or permanently, depending on the nature of the silver movement, rise above $20 within the next 12 months.

Company OverviewSilver Wheaton is a Canadian company that was created in its present form 18 months ago as an offshoot of the gold company Goldcorp. It is not a silver producer. Instead it helps mines with their financing by purchasing the mine’s forward byproduct silver production. Silver Wheaton looks to add value by purchasing these contracts at advantageous times in the price of silver, getting a good value for these contracts because of the financing needs of producers and by creating leverage that still retains limited downside.

Silver Wheaton plans to sell 15 million oz of silver in 2006 increasing to 16 million oz in 2007 and 2008 and to 20 million oz afterwards as a result of expected increases in production in their Lusimin mine and their new Glencore transaction. The company creates 20 to 25 year contracts by which they agree to purchase byproduct silver from long-lived mines. The contracts are structured such that the cost basis for the silver purchased is the lower of $3.90/oz or the market price. The cost basis only rises to adjust for inflation. The low cost basis is possible even at much higher silver levels because of offsetting upfront cash payments. The cost basis is structured to cover operational costs and ensure Silver Wheaton’s profitability even if prices were to fall dramatically.

Viability of Unique Business Model

The concept of Silver Wheaton works because silver is often a byproduct in most mines, such as gold or copper-zinc mines. Rather than using dilutions or other less desirable financing, mining companies can sell their silver for cash upfront to Silver Wheaton to help cover the very large startup costs of the mine. The mining company can then focus on making a profit from the primary metal(s) in the mine. Thus, this model will remain a good deal for both parties even if prices continue to rise. Therefore, Silver Wheaton can continue to purchase more silver production even as mining for the silver itself becomes profitable. It is not the case that they bought silver forward at a low price in the past and now cannot do this anymore to add value. Thus, Silver Wheaton can continue to use this model as new projects are brought online that need capital to start.

ManagementSilver Wheaton has some of the best management in the sector. The company is the brainchild of CEO Ian Telfer of Goldcorp, one of the best-managed and most successful gold companies in the last 5 years. Goldcorp currently owns 62% of Silver Wheaton and much of Silver Wheaton’s silver production comes from Goldcorp mines, as Goldcorp gave them a "sweetheart" deal to get the company started and gave Silver Wheaton instant legitimacy. Thus, Silver Wheaton can be trusted to manage the mining cycle well. They refinanced near the top on March 27th and purchased silver at good prices. Further, the company is just now maturing in its organization as Ian Telfer severed direct ties to Silver Wheaton by stepping down as a director. The ex-Goldcorp executives who have been running Silver Wheaton recently severed their direct ties to Goldcorp to focus on running Silver Wheaton. They have just last week appointed the permanent CEO, Peter Barnes who previously was serving as CFO of both Goldcorp and Silver Wheaton, replacing interim CEO Eduardo Luna, who is now the chairman. While these organizational changes do little to change the actual decision makers at Silver Wheaton, they show the company is leaving Goldcorp’s shadow and becoming more of a standalone company.

Business Risk

A key and potentially significant risk to Silver Wheaton, besides the price of silver, is the legal strength of Silver Wheaton’s contacts and the likelihood that they would be challenged. A linked risk is how guaranteed such production is and the safeguards to protect them are met. Silver Wheaton has this to say about contractual and mine risk.

“The Company has agreed to purchase all of the silver produced by the Luismin and Zinkgruvan mines. Other than the security interests which have been granted to Silver Wheaton, the Company has no contractual rights relating to the operations of Luismin or Zinkgruvan nor does it have any ownership interest in the mines. Other than the penalties payable by Goldcorp and Zinkgruvan to Silver Wheaton if, at the end of the Luismin or Zinkgruvan Guarantee Period, as applicable, the total number of ounces of silver sold to Silver Wheaton is less than the applicable minimum amount, the Company will not be entitled to any compensation if Luismin or Zinkgruvan does not meet its forecasted silver production targets in any specified period or if Luismin or Zinkgruvan shut down or discontinue their mining operations in Mexico and Sweden, respectively, on a temporary or permanent basis.”

However, it is important to note that a significant risk to traditional miners, country risk does not apply to Silver Wheaton. Even though they get silver from a Peruvian mine as a result of their new contract with Glencore, Peter Barnes has stated there is no country risk. They have diversified it away in the terms of the contract and receive the silver offshore. They get the amount of silver that is matched by the mine production as long as it is operating.

A small risk is a change in tax policies in either Canada or the Cayman Islands (where all operations are run) could change their current situation of not having to pay taxes. However, the Cayman Islands are traditionally a tax haven, and such risk seems very small.

HedgingAs previously stated, Silver Wheaton does not use hedging. Even though hedging near recent silver highs of $14.70 would lock in much higher earnings, this is not advantageous for them to do for two key reasons. First, nobody knows where silver is headed short term and it could have gone to $16 that week. Hindsight is 20/20 and this is certainly no exception. More importantly, Silver Wheaton is looking forward to the silver prices for the next two decades, where they see prices going substantially higher then $15. Thus, to become too short sighted and try to trade around the price is not their objective. Secondly, the shareholder base of Silver Wheaton is investing in the company as a pure play in silver and wants to capture all of the potential upside. Even though a hedge at $14 would lock in much higher earnings, it would cause investors to dump the stock, drastically lowering the multiple, as it would create a very negative signal about management. Therefore it is only in Silver Wheaton's interest to hedge if they felt the primary trend in silver had turned, something unlikely for many years.

Competition and AlternativesThe rest of the silver sector is also looking very attractive. The stocks of traditional silver miners are attractive because they have not moved up on the scale of Silver Wheaton and still have decent exposure to silver. Thus these companies will rise significantly as higher silver prices finally make them profitable. Currently these companies, which include Coure d’Alene, Hecla (HL), Apex (Sil), Pan American (PAAS) and Silver Standard (SSRI) remain depressed by their past history, the stock’s overhead resistance and their lack of significant profitability. Once silver starts significantly rising, such short term non-fundamental pressures will become meaningless, and they will correct to their true and significantly higher value.

However, they all still suffer from the traditional risks that go with mining companies, which is a significant amount of operating risk that Silver Wheaton does not have. On May 2nd, Bolivia nationalized gas fields and on fears that mine nationalization will be next, intraday Coure d’Alene was down 12% and Apex was down 30%. These fears have since been reduced. However, this is just the most recent example of the added risk traditional silver miners have. Further, most of the silver mines these companies operate yield significant amounts of gold. Thus, these companies are actually bimetal producers with no more than half of their revenue from silver sales. Therefore, Silver Wheaton remains the only equity pure play on silver. Also, many traditional silver miners are to some degree hedged. While hedging was a means of survival in the downturn, it is now a liability, causing losses and limiting the upside that precious metal investors seek. Therefore even as these undervalued traditional miners realize their value, Silver Wheaton should command a premium in a market looking for low operational risk and leverage to higher silver prices.

Financials

Balance Sheet and Solvency (refers to 2005 fiscal numbers as q1 2006 was reported during the closing of a silver purchase, temporarily changing the balance sheet makeup)

Silver Wheaton has an impeccable balance sheet. It has no long term debt and historically retains large amounts of cash. It also has very low accounts receivable and payable at all times, reducing most financial and operating risk. At the end of the 2005 fiscal year Silver Wheaton had 44% of assets in cash, or $117.7 million. This is partially for defensive purposes, but Silver Wheaton’s cost basis would keep them solvent long after most silver companies would be near bankruptcy if silver prices collapse. The large cash reserves mainly show Silver Wheaton can be opportunistic in purchasing new silver, as shown last month.

Income Statement and Profitability

Silver Wheaton is very profitable with extremely high profit margins for any company and particularly for a precious metal company. Silver Wheaton sold its silver in the first quarter for an average price of $9.62 with a cost basis of $3.90. Current gross margins were 60%. Accounting for depreciation, operating and profit margins were both 53% because the small operating costs were offset by interest earned on cash. No taxes were paid because the company operations are run by a subsidiary based in the Cayman Islands. Silver Wheaton should remain increasingly profitable as silver prices rise and will remain profitable even if silver prices were to fall below $5.

Earnings and Sensitivity Analysis

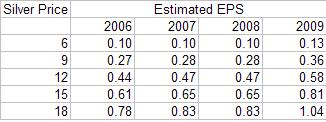

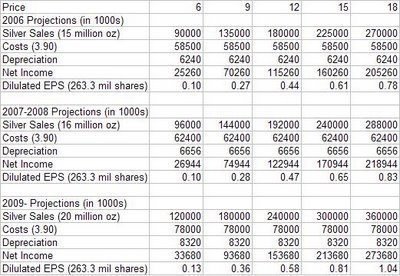

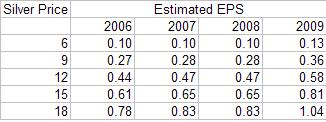

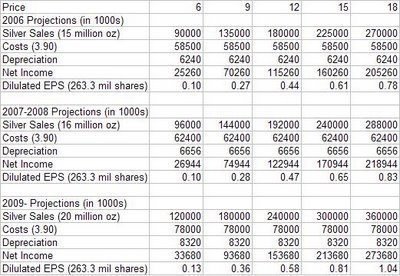

Silver Wheaton earned $.15 last year on an average silver price of $7.31. In absence of new value added contracts, earnings growth is directly related to the rise in silver prices. This year’s first quarter earnings were $.07, beating consensus estimates of $.06. Analysts will have to revise their earnings of $.28 for 2006 and $.20 for 2007 as silver has gone significantly higher. However this is partially priced in as few precious metal investors listen to analysts in this undercovered sector. Since Silver Wheaton is such a transparent company, analysts in determining earnings are mainly forecasting silver prices. As no one knows what silver prices will be, it is best to perform an earnings sensitivity analysis to determine what earnings will be given a certain silver price.

See Appendix for Earnings Calculation and Assumptions

As evidenced in the table above, as long as silver remains above 9 dollars for the rest of the year, estimates are too low.

PE Valuation

Under street estimates, the PE is 40, which is acceptable for a company with earnings growth that could easily be over 30% for the next few years. Yet, forecasting a reasonably and possibly still conservative average silver price of $12 for 2006, earnings for Silver Wheaton rise to $.44, making the PE 24. At an average price of $15 in 2007 with earnings at $.65, forward PE is 16. This is very low given the room for higher earnings growth and the growth of production in 2009. The premium Silver Wheaton should command given its low risk and pure play on silver makes Silver Wheaton very cheap on a PE basis.

Silver Outlook

Silver has been outperforming gold by a wide margin. This trend is likely to continue.

Fundamentals

Silver trades with a high correlation to gold given that both are commodities that have a role as alternative monetary instruments whose price is linked to the value of the dollar. However, the key difference between gold and silver is silver is both a base and precious metal. Since silver is used up in many industrial uses, supply available is often very tight.

There are many uses for silver, and they are increasing. New uses include many diverse and growing medical and anti-bacterial applications, already approximately 40% of the market. Additionally, perception that photography demands for silver, which constitute approximately 22% of demand, will fall have been overstated. This is because the growth of digital camera use have been overstated as most of the world still uses traditional cameras and digital cameras create more demand for photographic paper. However, the fall in photography use will also lead to a drop in the scrap silver recycling supply. These growing demands put the silver market which is already very tight, into a major supply/demand imbalance.

Finally, supply has become tight in all commodities, as years of very low prices meant low capital expenditures where it takes years to open new production. However, the situation with silver makes supply particularly tight. There are few mines in the world where silver is the primary revenue source because such locations are not as common and it has not been economical to operate one in decades. Thus most silver production is a byproduct of production at other mines, primarily those that produce gold or copper-zinc. Therefore, increasing production specifically of silver is going to be especially difficult as few mines focus on it.

Therefore, silver is unique because a combination of factors lead to a uniquely tight market which in periods of high demand, such as the recent introduction of the ETF, silver is prone to incredible spikes. Further, it has more diversified demand factors as a result of its dual role of significant industrial and monetary uses.

Precious Metal Long Term ForecastThe main catalyst for the major oncoming rally and cushion to prevent any meaningful correction is the very large commercial short position in precious metals. As of April 25th, the commercial traders were long 24,842 and short 84,940 silver contracts, making them net short 60098 contracts with overall open interest at 127,250 contracts. The smartest traders like those at Goldman Sachs, have been very net short precious metals for the last five years. Regardless of why they are, Goldman and other commercial shorts are on the wrong side the trend. This is not a signal that prices are overvalued because there are too many long term bullish forces. This leads to the possibility that the commercial shorts have another agenda than just making money paper trading commodities. The most logical explanation for why this has been happening is that the commercials have been manipulating the market. Whether such a possibility is the reason or not, the heavy short position remains regardless of what the explanation of it is.

The commercial short manipulation of the markets downward can only be a short term effect. Even the most powerful forces cannot stop physical buying and the forces of supply and demand that have been exacerbated by downward price manipulation. The consequence of this is that any large correction considering how high the prices have been going is going to lead to massive covering and any upside surge could lead to a major squeeze.

This squeeze, which has become very likely because long term forces outweigh manipulation, will be more powerful the longer it is delayed. When it does happen it will finally attract the interest of the retail investor and only then will the bubble begin. The formation of the precious metals bubble is likely still years away, and even after that prices will remain at levels much higher than current levels.

Conclusion

Based on the long term outlook on silver and other correlated precious metals, exposure to the silver is advisable. Of the ways to gain silver exposure, equities will outperform metal exposure over the long run based on leverage. Silver Wheaton is a hybrid of a producer and a managed precious metal fund. It is unique in the precious metal space in offering both leveraged exposure without added operational risk. It is also unique in the precious metal fund space as it has no fees. Silver Wheaton is therefore the most attractive way to participate in any further silver upside.

Note: All financial data comes from the 2006 Q1 quarterly report unless otherwise noted

Appendix

Earnings Forecast

Assumptions for this model are that Silver Wheaton is selling 15 million oz of silver in 2006, 16 million in 2007-2008 and 20 million in 2009. Outstanding shares are 263.3 million. Depreciation is assumed to be fixed and increases with the growth of the amount of silver sold. No taxes are paid. Operating costs are assumed to remain constant and negligible, at around two million dollars (roughly .007 EPS), and will be offset by interest revenue.

![[Most Recent Charts from www.kitco.com]](http://kitconet.com/charts/metals/gold/t24_au_en_usoz_4.gif)